Embark on a journey to securing your future with Over 50 Life Cover, all without the hassle of a medical exam. This insurance option is designed to cater to individuals aged 50 and above, offering a range of benefits and features that ensure peace of mind for the future.

Introduction to Over 50 Life Cover

Over 50 Life Cover is a type of insurance specifically designed for individuals who are over the age of 50. It provides financial protection for your loved ones in the event of your passing, offering peace of mind and security for the future.

Significance of Over 50 Life Cover

As individuals reach the age of 50 and beyond, they may start thinking about their legacy and how to provide for their family after they are gone. Over 50 Life Cover can help cover funeral expenses, outstanding debts, or leave a financial cushion for loved ones.

Benefits of Over 50 Life Cover

- Provides financial security for your family

- Guaranteed acceptance with no medical exam required

- Payouts are tax-free

- Premiums are fixed for life

Key Features of Over 50 Life Cover Policies

- Minimum and maximum coverage amounts

- Age eligibility criteria

- Fixed premiums that do not increase with age

- Payouts typically range from a few thousand to tens of thousands of pounds

No Medical Exam Requirement

When it comes to Over 50 Life Cover, one of the key benefits is the absence of a medical exam requirement. This means that individuals over the age of 50 can secure life insurance coverage without having to undergo a medical examination.

Significance of No Medical Exam

Not requiring a medical exam for Over 50 Life Cover is significant because it simplifies the application process and makes it more accessible to individuals who may have pre-existing medical conditions or concerns about their health.

Application Process Comparison

With policies that do require a medical exam, the application process can be more time-consuming and may involve additional steps. On the other hand, applying for Over 50 Life Cover without a medical exam is usually quicker and more straightforward.

Eligibility Criteria

- Typically, individuals aged 50 and above are eligible for Over 50 Life Cover without a medical exam.

- Some insurance providers may have specific criteria related to age, health status, and coverage amount.

- Applicants may need to answer some health-related questions as part of the application process.

Coverage Options and Limits

When it comes to Over 50 Life Cover, there are different coverage options available to suit various needs and financial situations. Policies with no medical exams offer a convenient way to secure coverage without the hassle of undergoing a medical assessment.

Let's take a closer look at the typical coverage limits for these policies and how they compare to those with medical exams.

Different Coverage Options

- Standard Coverage: Provides a lump sum payout to beneficiaries upon the policyholder's passing.

- Enhanced Coverage: Offers additional benefits such as critical illness cover or funeral expenses.

- Joint Coverage: Allows couples to be covered under a single policy, with benefits payable upon the passing of either individual.

Typical Coverage Limits

- Policies with No Medical Exams: Coverage limits for these policies typically range from £2,000 to £25,000, depending on the insurer.

- Policies with Medical Exams: Coverage limits for policies that require medical exams can go up to £500,000 or more, based on the individual's health and financial situation.

Scenarios for Different Coverage Options

- Standard Coverage: Ideal for individuals looking to provide financial security for their loved ones and cover basic expenses.

- Enhanced Coverage: Suitable for those seeking additional protection against critical illnesses or wanting to cover funeral costs.

- Joint Coverage: Perfect for couples who want to ensure financial stability for their partner in the event of either person's passing.

Premiums and Cost Analysis

When it comes to Over 50 Life Cover, the calculation of premiums is based on several factors that determine the cost of the policy. Understanding how premiums are calculated and comparing the costs of policies with and without medical exams can help you find an affordable option that meets your needs.

Factors Influencing Premium Costs

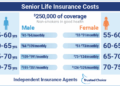

- The age of the policyholder: Generally, the older you are when you take out the policy, the higher the premiums will be.

- The coverage amount: The higher the coverage amount you choose, the higher the premiums will be.

- Health condition: Policies that require a medical exam may offer lower premiums for individuals in good health.

- Smoking status: Smokers typically pay higher premiums compared to non-smokers.

- Gender: Some policies may have different premium rates based on gender.

Cost Analysis: Policies with vs. without Medical Exams

On average, policies that require a medical exam may offer lower premiums compared to those without, especially for individuals in good health.

- For policies without medical exams, the premiums may be higher to compensate for the lack of health information.

- Policies with medical exams may provide more accurate risk assessment, leading to potentially lower premiums.

- It is essential to compare the costs of different policies to determine the most cost-effective option for your situation.

Tips for Finding Affordable Over 50 Life Cover

- Shop around and compare quotes from different insurance providers to find the best rates.

- Consider adjusting the coverage amount to a level that meets your needs without paying for unnecessary benefits.

- Maintain a healthy lifestyle to potentially qualify for lower premiums, especially for policies that require a medical exam.

- Consult with an insurance advisor to explore all available options and find a policy that fits your budget and coverage requirements.

Ending Remarks

In conclusion, Over 50 Life Cover with No Medical Exam provides a valuable safety net for those in their golden years, allowing them to protect their loved ones and assets without the need for intrusive medical evaluations. Make the smart choice today and secure your future with this hassle-free insurance option.

User Queries

What are the key features of Over 50 Life Cover?

The key features include guaranteed acceptance, fixed premiums, and coverage for funeral expenses.

How are premiums calculated for Over 50 Life Cover?

Premiums are typically based on factors like age, health condition, and desired coverage amount.

What are the eligibility criteria for obtaining Over 50 Life Cover without a medical exam?

To qualify, individuals usually need to be within a certain age range and meet basic health requirements set by the insurer.

Are there different coverage options available for Over 50 Life Cover?

Yes, policyholders can choose between options like term life or whole life coverage.

How do policies with and without medical exams differ in terms of coverage limits?

Policies without medical exams may have lower coverage limits compared to those that require a medical evaluation.

![10 Best Whole Life Insurance for Seniors [Top-Rated Companies]](https://medic.radarbanten.co.id/wp-content/uploads/2025/12/BestTermLifeInsuranceCompanies-final-b2106835adde47b1ac9cf2942968ad13-120x86.png)