Exploring the realm of life insurance options for individuals over 50 in the digital age opens up a world of possibilities and considerations. As technology continues to shape our lives, understanding the nuances of life insurance becomes crucial for this demographic.

From term life to whole life options, the landscape is rich with choices tailored to meet the unique needs of those in their golden years.

Delving deeper into the specifics, we uncover the significance of different policies, the application process, and the role of digital tools in simplifying decisions. Let's embark on a journey to unravel the mysteries of life insurance in the digital era for individuals over 50.

Life Insurance Options for People Over 50 in the Digital Age

As individuals reach the age of 50 and beyond, the importance of having a life insurance policy becomes more significant. Life insurance can provide financial protection for your loved ones in the event of your passing, ensuring that they are taken care of financially.

Term Life Insurance vs. Whole Life Insurance

When considering life insurance options, individuals over 50 often have to choose between term life insurance and whole life insurance. Here is a comparison of the two:

- Term Life Insurance:This type of policy provides coverage for a specific term, typically 10, 20, or 30 years. It is generally more affordable than whole life insurance and can be a good option for those looking for temporary coverage.

- Whole Life Insurance:Whole life insurance provides coverage for your entire life as long as premiums are paid. It also includes a cash value component that grows over time. While it is more expensive than term life insurance, it offers lifelong protection and can serve as an investment vehicle.

Key Factors to Consider When Choosing a Life Insurance Policy

When selecting a life insurance policy as an individual over 50, there are several important factors to take into account:

- Financial Needs: Consider the financial needs of your dependents and beneficiaries, including outstanding debts, future expenses, and income replacement.

- Health Condition: Your current health condition can impact the type of policy you qualify for and the premiums you will pay. Be prepared to undergo a medical examination for certain policies.

- Coverage Amount: Determine the appropriate coverage amount based on your financial obligations and goals. It is essential to strike a balance between adequate coverage and affordability.

- Policy Riders: Explore optional policy riders that can enhance your coverage, such as accelerated death benefits, waiver of premium, or long-term care benefits.

- Insurance Company Reputation: Choose a reputable insurance company with a strong financial rating to ensure they will be able to fulfill their financial obligations in the future.

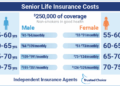

Term Life Insurance for Individuals Over 50

Term life insurance is a type of life insurance that provides coverage for a specified period, typically ranging from 10 to 30 years. This option is popular among individuals over 50 because it offers affordable premiums and straightforward coverage. Unlike whole life insurance, term life insurance does not accumulate cash value over time, making it a more cost-effective choice for older individuals who may not need life insurance coverage for their entire lifetime.

Examples of Term Life Insurance Policies

- Policy A: A 20-year term life insurance policy designed for individuals aged 50-59, with coverage amounts ranging from $100,000 to $500,000.

- Policy B: A 15-year term life insurance policy specifically tailored for individuals over 60, offering coverage from $50,000 to $250,000.

Applying for Term Life Insurance Online

Applying for term life insurance online has become increasingly convenient in the digital age. Many insurance providers offer online application processes that allow individuals to compare quotes, select coverage options, and complete the application from the comfort of their own homes.

The process typically involves filling out a detailed questionnaire about health, lifestyle, and coverage preferences, followed by a medical exam or review of medical records. Once approved, the policy can be purchased and managed online, providing ease and accessibility for individuals over 50 looking for life insurance coverage.

Whole Life Insurance for Individuals Over 50

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which covers a specific period, whole life insurance offers lifelong protection as long as premiums are paid.

Features of Whole Life Insurance

Whole life insurance not only provides a death benefit to beneficiaries upon the insured's passing, but it also accumulates cash value over time. This cash value grows tax-deferred and can be accessed by the policyholder through loans or withdrawals. Additionally, whole life insurance premiums remain level throughout the life of the policy, providing predictability and stability.

Comparison with Term Life Insurance

- Whole life insurance typically has higher premiums compared to term life insurance due to its lifelong coverage and cash value component.

- While term life insurance only provides coverage for a specific term, whole life insurance offers permanent protection and the opportunity to build cash value.

- Term life insurance is generally more affordable, making it a popular choice for individuals seeking temporary coverage, while whole life insurance serves as a long-term financial planning tool.

Whole Life Insurance as an Investment Tool

Whole life insurance can act as an investment tool due to its cash value component. The cash value grows over time, providing a source of funds that can be used for various purposes, such as supplementing retirement income, funding education expenses, or covering emergency costs.

Additionally, the cash value can be accessed through policy loans without impacting the death benefit, offering flexibility and financial security.

Digital Tools and Resources for Choosing Life Insurance

Life insurance is an important decision, especially for individuals over 50. With the advancements in technology, there are now numerous digital tools and resources available to help make the process easier and more efficient.

Using Online Calculators to Determine Life Insurance Needs

Online calculators are a convenient way to estimate how much life insurance coverage you may need based on your financial situation and future expenses. These tools typically take into account factors such as your age, income, debts, and desired coverage amount.

By inputting this information, you can get a rough idea of the type and amount of life insurance that may be suitable for you.

- Consider using a reputable online life insurance calculator to get an estimate of your coverage needs.

- Take into account factors like outstanding debts, mortgage payments, education expenses, and future financial goals.

- Remember that these calculators provide estimates and it's always best to consult with a financial advisor for personalized advice.

Reputable Websites for Comparing Life Insurance Quotes

When shopping for life insurance, it's essential to compare quotes from different providers to ensure you're getting the best coverage at a competitive price. There are several reputable websites that allow you to compare life insurance quotes from multiple insurers at once, making it easier to find a policy that fits your needs and budget.

- Use trusted websites like Policygenius, NerdWallet, or Insure.com to compare life insurance quotes from various providers.

- Compare not only the premium rates but also the coverage options, terms, and customer reviews of different insurers.

- Take your time to research and compare before making a decision to ensure you're getting the best value for your money.

Step-by-Step Tutorial on Purchasing Life Insurance Online

Purchasing life insurance online is now easier than ever, thanks to streamlined processes and user-friendly interfaces. Follow this step-by-step guide to help you navigate through the online purchasing process smoothly.

- Research and compare different life insurance policies and providers using online resources.

- Use an online calculator to estimate your coverage needs based on your financial situation and future expenses.

- Fill out an online application form with accurate information about yourself and your health status.

- Review the policy details, coverage terms, and premium rates before making a final decision.

- Complete the purchase by making the initial payment online and signing the necessary documents electronically.

Conclusive Thoughts

In conclusion, navigating the realm of life insurance options for individuals over 50 in the digital age demands a blend of insight, foresight, and the right tools at one's disposal. As we bid farewell to this discussion, armed with newfound knowledge and understanding, may the path to securing the ideal life insurance policy be smoother and more informed for all those embarking on this journey.

FAQs

What are the key factors to consider when choosing a life insurance policy?

Key factors include the individual's financial situation, health status, coverage needs, and long-term goals. It's essential to assess these aspects to determine the most suitable policy.

How does whole life insurance act as an investment tool?

Whole life insurance not only provides coverage but also accumulates cash value over time, which can be borrowed against or withdrawn. This feature makes it a dual-purpose financial instrument.

![10 Best Whole Life Insurance for Seniors [Top-Rated Companies]](https://medic.radarbanten.co.id/wp-content/uploads/2025/12/BestTermLifeInsuranceCompanies-final-b2106835adde47b1ac9cf2942968ad13-120x86.png)