Exploring the ins and outs of comparing life insurance quotes without hidden fees, this introduction sets the stage for an informative and engaging discussion that delves into the nuances of the insurance industry.

The following paragraphs will break down key concepts and provide actionable tips for navigating the world of life insurance quotes effectively.

Understanding Life Insurance Quotes

When comparing life insurance quotes, it is essential to understand the key components that make up these quotes. By familiarizing yourself with the terms and calculations involved, you can make an informed decision when choosing the right life insurance policy.

Components of a Life Insurance Quote

- The Death Benefit: This is the amount of money that will be paid out to your beneficiaries upon your death.

- Premiums: These are the payments you make to the insurance company in exchange for coverage.

- Policy Term: The length of time the insurance coverage will be in effect.

- Riders: Additional features or benefits that can be added to your policy for an extra cost.

Key Terms to Look For

- Guaranteed vs. Non-Guaranteed: Guaranteed means the terms of the policy will not change, while non-guaranteed terms may vary.

- Cash Value: Some policies accumulate cash value over time, which can be borrowed against or withdrawn.

- Underwriting: The process of evaluating your risk as a policyholder and determining your premium.

Calculating Life Insurance Quotes

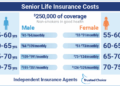

- Age, health, lifestyle, and coverage amount are key factors in determining your premium.

- Insurance companies use actuarial tables and algorithms to assess risk and set prices.

- Comparing quotes from multiple insurers can help you find the best coverage at the most competitive rates.

Avoiding Hidden Fees

When comparing life insurance quotes, it is crucial to be aware of hidden fees that could significantly impact the overall cost of your policy. These fees are often buried in the fine print, making it essential to know what to look out for to avoid any surprises down the line.

Examples of Common Hidden Fees

- Policy Fees: These are administrative fees charged by the insurance company to cover the cost of processing your policy.

- Surrender Charges: If you cancel your policy early, you may be subject to surrender charges, which can eat into your cash value.

- Rider Fees: Additional coverage options, known as riders, often come with extra fees attached.

- Underwriting Fees: Some insurers charge fees for the underwriting process, which determines your risk profile and premium rates.

Strategies to Identify and Avoid Hidden Fees

- Read the Fine Print: Take the time to carefully review all the details of the policy, including any additional documents or disclosures.

- Ask Questions: Don't hesitate to ask your insurance agent or broker about any potential fees that are not clearly explained.

- Compare Multiple Quotes: By getting quotes from different insurers, you can compare not only the premiums but also any hidden fees that may be present.

- Look for Fee-Free Options: Some insurers offer policies with no hidden fees or lower fees, so be sure to explore all your options.

Impact of Hidden Fees on the Overall Cost

Hidden fees can significantly increase the total cost of your life insurance policy over time, reducing the value of your coverage and potentially affecting your financial plans.

Comparing Quotes Effectively

When comparing life insurance quotes, it is crucial to look beyond just the premium amount to ensure you are getting the best coverage for your needs. Here's a step-by-step process to help you effectively compare different life insurance quotes and make an informed decision

Assess Coverage Options Beyond Premium

- Look at the coverage amount: Consider how much coverage each policy offers to ensure it meets your financial needs in case of an unfortunate event.

- Review the policy terms: Understand the terms and conditions of each policy, including any exclusions or limitations that may impact your coverage.

- Compare additional benefits: Some policies may offer additional benefits such as riders for critical illness or disability coverage. Evaluate these extras to see which policy provides the most comprehensive coverage.

- Consider the insurer's reputation: Research the insurance company's reputation for customer service, claim settlement, and financial stability to ensure you are choosing a reliable provider.

Importance of Comparing Similar Policies

- Compare apples to apples: When evaluating quotes, make sure you are comparing similar policies with the same coverage amount and term length. This ensures a fair comparison of premiums and benefits.

- Pay attention to exclusions: Check for any exclusions or limitations in each policy to understand what is covered and what is not. This will help you make an accurate comparison of the coverage offered.

- Consider the long-term costs: While the premium is an important factor, also consider the long-term costs of the policy, including any potential rate increases or fees that may affect the overall affordability.

- Seek professional advice: If you are unsure about which policy to choose, consider seeking advice from a financial advisor or insurance agent who can help you understand the differences between policies and make an informed decision.

Transparency in Quotes

Transparency in life insurance quotes is crucial as it ensures that you fully understand the terms, coverage, and costs associated with the policy you are considering. Without transparency, you may end up with hidden fees, inadequate coverage, or unexpected surprises down the line.

Importance of Transparency

Transparency allows you to make informed decisions about your life insurance policy. It helps you compare quotes effectively, understand what you are paying for, and avoid any unpleasant surprises in the future. When quotes are transparent, you can trust that the insurance company is being honest and upfront about the terms of the policy.

Tips for Ensuring Transparency

- Ask for a detailed breakdown of the costs and coverage included in the quote.

- Read the fine print and ask questions about anything that is unclear.

- Compare quotes from multiple insurance providers to see if there are any discrepancies.

- Look for reviews and ratings of the insurance company to gauge their reputation for transparency.

- Work with a licensed insurance agent who can help you understand the quotes and navigate any complex terms.

Regulations and Transparency

Regulations play a vital role in promoting transparency in the insurance industry. Government agencies and industry watchdogs set guidelines and standards that insurance companies must follow to ensure that quotes are clear, accurate, and honest. These regulations help protect consumers from deceptive practices and ensure that they can make well-informed decisions when purchasing life insurance.

Closure

In conclusion, understanding how to compare life insurance quotes without hidden fees is essential for making informed decisions about your coverage. By following the strategies Artikeld here, you can ensure transparency and avoid unnecessary costs in your life insurance policy.

Questions Often Asked

What are some common hidden fees in life insurance quotes?

Common hidden fees in life insurance quotes include underwriting fees, policy fees, and surrender charges. It's important to carefully review the fine print to identify these potential costs.

How can I effectively compare different life insurance quotes?

To compare life insurance quotes effectively, you should analyze not just the premium but also the coverage options, exclusions, and riders. Make sure to compare policies with similar coverage to get an accurate comparison.

Why is transparency important in life insurance quotes?

Transparency in life insurance quotes ensures that you understand the full cost of your policy and can make informed decisions. It helps you avoid surprises and hidden costs down the line.

![10 Best Whole Life Insurance for Seniors [Top-Rated Companies]](https://medic.radarbanten.co.id/wp-content/uploads/2025/12/BestTermLifeInsuranceCompanies-final-b2106835adde47b1ac9cf2942968ad13-120x86.png)