Exploring the realm of Affordable Life Insurance Plans for Retirees in 2025, this introduction sets the stage for an insightful discussion on the importance of financial security in retirement. With a focus on key factors and emerging trends, this piece aims to provide valuable information for retirees seeking the best insurance options.

Understanding the Importance of Life Insurance for Retirees

Life insurance plays a crucial role in providing financial security for retirees and their loved ones. It offers peace of mind knowing that there is a safety net in place to cover expenses and protect assets. Let's delve into how life insurance can benefit retirees.

Ensuring Financial Stability

- Life insurance can help cover outstanding debts, such as mortgages or loans, ensuring that retirees do not burden their loved ones with financial obligations.

- It can provide a source of income replacement for surviving spouses or dependents, helping them maintain their standard of living.

- With the right policy, retirees can also leave a legacy for their heirs, whether it's to cover funeral expenses or pass on wealth to the next generation.

Peace of Mind and Security

- Life insurance can offer peace of mind, knowing that loved ones will be financially protected in the event of the retiree's passing.

- It provides a sense of security and stability during retirement years, allowing retirees to enjoy their golden years without worrying about financial uncertainties.

- Having life insurance can also help retirees feel more confident in their financial planning, knowing that unexpected expenses or emergencies are covered.

Factors to Consider When Choosing Affordable Life Insurance Plans

When retirees are selecting a life insurance plan, there are several key factors they should consider to ensure they choose the most affordable option that meets their needs.

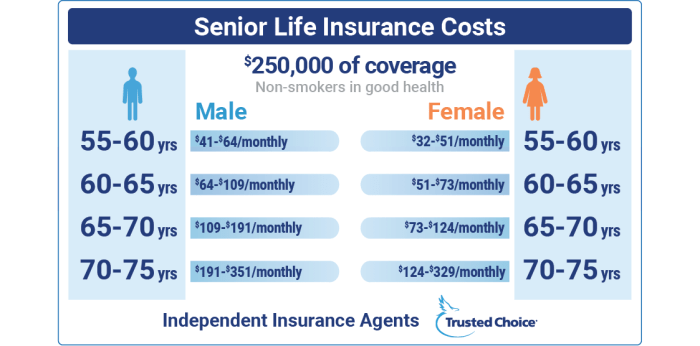

- 1. Coverage Amount: Retirees should assess their financial obligations and determine the appropriate coverage amount to secure their loved ones' financial stability.

- 2. Premium Costs: Compare premiums from different insurance providers to find a plan that fits within your budget without compromising the coverage.

- 3. Policy Type: Consider the types of life insurance plans available, such as term life or whole life insurance, and choose one that aligns with your goals and financial situation.

- 4. Riders and Add-ons: Evaluate additional policy features like riders for critical illness or long-term care to enhance your coverage based on your specific needs.

- 5. Insurer's Reputation: Research the insurance company's reputation, financial stability, and customer service to ensure they can fulfill their obligations when needed.

Health Conditions Impact on Life Insurance Affordability

Health conditions can significantly impact the affordability of life insurance for retirees. Insurers often consider an individual's health status when determining premiums and coverage options.

- 1. Underwriting Process: Insurers may require retirees to undergo medical exams to assess their health and determine the risk of insuring them, which can affect premium costs.

- 2. Pre-existing Conditions: Retirees with pre-existing health conditions may face higher premiums or limited coverage options, depending on the severity of their condition.

- 3. Lifestyle Factors: Factors like smoking, obesity, or a sedentary lifestyle can also influence life insurance premiums for retirees, as they are considered higher risk by insurers.

- 4. Health Improvements: Retirees who have made positive lifestyle changes or have managed their health conditions effectively may qualify for lower premiums through improved underwriting terms.

Trends in Life Insurance Plans for Retirees in 2025

In recent years, there have been notable trends in life insurance offerings specifically designed for retirees. These trends are influenced by various factors such as advancements in technology, changing consumer preferences, and regulatory changes in the insurance industry.

Personalized Life Insurance Plans

With the help of technology and data analytics, insurance companies are now able to offer personalized life insurance plans tailored to the unique needs of retirees. These plans take into account factors such as health conditions, lifestyle choices, and financial goals to provide retirees with coverage that meets their specific requirements.

Flexible Premium Options

In 2025, retirees can expect to see more flexible premium options when it comes to life insurance plans. Insurance companies are offering innovative payment structures that allow retirees to adjust their premiums based on their financial situation. This flexibility ensures that retirees can continue to afford their life insurance coverage even as they navigate retirement.

Digital Platforms for Easy Access

Technology has played a significant role in shaping the way retirees access and manage their life insurance plans. In 2025, retirees can expect to see more user-friendly digital platforms that make it easy to review policy details, make changes to coverage, and file claims online.

These digital platforms enhance convenience and accessibility for retirees.

Regulatory Changes Promoting Consumer Protection

Regulatory changes in the insurance industry have also influenced the trends in life insurance plans for retirees. In 2025, there is a focus on enhancing consumer protection through regulations that ensure transparency, fairness, and accountability in the sale and servicing of life insurance policies.

These regulatory changes aim to safeguard the interests of retirees and promote trust in the insurance industry.

Strategies to Find Affordable Life Insurance Plans for Retirees

When it comes to finding affordable life insurance plans for retirees, there are several strategies that can help individuals secure cost-effective coverage that meets their needs. From comparing quotes to exploring alternative ways to lower premiums, retirees have options to navigate the life insurance market efficiently.

Comparing Quotes from Different Insurance Providers

One of the most effective strategies for finding affordable life insurance plans is to compare quotes from different insurance providers. By obtaining quotes from multiple companies, retirees can identify the best rates and coverage options available to them. It is essential to consider not only the premium cost but also the features and benefits included in each policy.

Exploring Alternative Ways to Lower Premiums

Retirees can also explore alternative ways to lower their life insurance premiums. This can include opting for a term life insurance policy instead of a whole life policy, as term life insurance tends to be more affordable. Additionally, retirees can consider adjusting the coverage amount or opting for a policy with a shorter term to reduce costs.

Epilogue

In conclusion, Affordable Life Insurance Plans for Retirees in 2025 offer a crucial safety net for financial well-being during retirement. By considering various factors and staying informed about the latest trends, retirees can make informed decisions to protect their future.

FAQ

Why is life insurance important for retirees?

Life insurance provides financial security for retirees and their loved ones, ensuring peace of mind during retirement.

How can health conditions impact the affordability of life insurance for retirees?

Health conditions can increase premiums for life insurance, making it important for retirees to explore different options based on their health status.

What are some strategies to find affordable life insurance plans for retirees?

Retirees can find cost-effective plans by comparing quotes, exploring different types of insurance, and considering alternative ways to lower premiums.

![10 Best Whole Life Insurance for Seniors [Top-Rated Companies]](https://medic.radarbanten.co.id/wp-content/uploads/2025/12/BestTermLifeInsuranceCompanies-final-b2106835adde47b1ac9cf2942968ad13-75x75.png)

![10 Best Whole Life Insurance for Seniors [Top-Rated Companies]](https://medic.radarbanten.co.id/wp-content/uploads/2025/12/BestTermLifeInsuranceCompanies-final-b2106835adde47b1ac9cf2942968ad13-120x86.png)